What is NPV (Net Present Value)?

What is NPV in Finance?

In finance, Net Present Value (NPV) is one of the most important concepts for evaluating whether an investment or project is worthwhile. At its core, what is NPV can be explained as the difference between the present value of future cash inflows and the present value of cash outflows over a given period of time. In simple terms, it shows how much value an investment is expected to create after considering the time value of money.

The reason what is NPV in finance matters so much is because money today is worth more than the same amount in the future, due to inflation, risk, and opportunity costs. By discounting future cash flows back to their present value, NPV helps businesses and investors decide whether an investment will generate a positive return or lead to losses.

A positive NPV indicates that an investment is expected to create wealth, while a negative NPV suggests it may destroy value. This makes NPV a cornerstone of capital budgeting, investment analysis, and financial planning. Whether deciding on a new project, buying equipment, or evaluating acquisitions, understanding NPV ensures smarter, data-driven financial decisions.

Understanding the Concept of NPV

At its core, the net present value meaning lies in its ability to measure how much future cash flows are worth in today’s terms. NPV discounts expected earnings from an investment back to the present, allowing investors and businesses to determine whether a project creates or destroys value.

The foundation of NPV is the time value of money—the principle that a dollar today is worth more than a dollar in the future because of inflation, risk, and the potential to earn returns elsewhere. By applying a discount rate (often the cost of capital), NPV adjusts future inflows and outflows to reflect their present value.

Example: Value Today vs. Value in 5 Years

Imagine receiving $1,000 today versus $1,000 five years from now. Without discounting, they may seem equal. However, if the discount rate is 8%, the future $1,000 is worth only about $681 today.

This simple comparison highlights why NPV matters: it doesn’t just look at future profits, but evaluates them in today’s value terms. With NPV explained in this way, it becomes clear why it is a cornerstone of financial decision-making. Checkout Our: Finance & Budgeting Training Courses

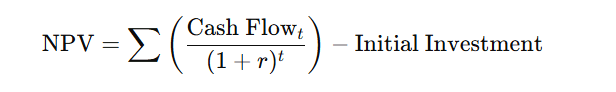

The NPV Formula and Discount Factor

To calculate the value of an investment, finance professionals use the NPV calculation formula:

Explanation of Components

- Cash Flow (CFₜ): The expected inflow or outflow of money in a specific year t.

- Rate (r): The discount rate, often the company’s cost of capital or required rate of return.

- Time (t): The year in which the cash flow occurs.

- Discount Factor: The present value multiplier applied to each future cash flow, expressed as:

Discount Factor= 1/ (1+r)^t

The discount factor adjusts each future payment into today’s value, reflecting the time value of money. This makes it clear what is the discount factor in NPV—it’s the tool that converts future values into their equivalent worth today.

Example: Discount Factor in Action

Suppose an investment promises $1,000 in 3 years, and the discount rate is 10%.

Discount Factor= 1/(1+0.10)^3 = 1/1.331 ≈ 0.751

Present Value=1000×0.751=751

So, the $1,000 expected in 3 years is worth only $751 today. When applied to multiple years and cash flows, these present values are added together, then the initial investment is subtracted to find the NPV.

This demonstrates why the NPV calculation formula is vital—it ensures future earnings are valued realistically when making investment decisions. Checkout Our: Tax and Revenue Training Courses

How to Calculate NPV in Excel

One of the easiest ways to compute Net Present Value is by using spreadsheets. Knowing what is NPV in Excel helps investors and businesses quickly analyze projects without complex manual calculations. Excel offers two powerful functions: NPV() for regular cash flows and XNPV() for irregular cash flows.

Method 1: Using the =NPV() Function

The Excel NPV formula is:

=NPV(discount_rate, value1, value2, …) – Initial Investment

Example:

An investment costs $5,000 today and is expected to return $2,000 per year for 3 years at a discount rate of 10%.

=NPV(10%,2000,2000,2000)-5000

Result: NPV = -$507, meaning the project reduces value and may not be worthwhile.

Method 2: Using the =XNPV() Function

For projects with irregular cash flows, Excel’s XNPV() function is more accurate because it considers actual dates.

=XNPV(discount_rate, cash_flows, dates)

Example:

If cash inflows of $2,000 occur on different dates instead of evenly every year, you can use:

=XNPV(10%, { -5000, 2000, 2000, 2000 }, { “01/01/2024″,”01/01/2025″,”07/01/2026″,”01/01/2027” })

This ensures each cash flow is discounted according to its exact timing.

Why Use Excel for NPV?

Fast and accurate calculations

Handles both regular and irregular cash flows

Widely used in finance for capital budgeting and investment analysis

By applying the Excel NPV formula, businesses and investors can make better-informed financial decisions with just a few keystrokes. Explore Our: Investment Management Training Courses

What is NPV and IRR?

When analyzing investments, two of the most widely used metrics are NPV and IRR. Both are essential in capital budgeting but serve different purposes. Understanding what is NPV and IRR together gives a complete picture of whether a project is financially viable.

Defining IRR

The Internal Rate of Return (IRR) is the discount rate that makes the Net Present Value of all future cash flows equal to zero. In other words, IRR shows the exact annual rate of return a project is expected to generate.

Relationship Between NPV and IRR

- NPV explained: Measures the absolute dollar value created (wealth added or lost).

- IRR explained: Shows the percentage return earned by the project.

- Connection: When NPV = 0, the corresponding discount rate is the project’s IRR.

This relationship makes it clear why financial analysts often use both together: NPV tells you how much value is created, while IRR tells you the project’s effective growth rate.

Example: Project Comparison Using NPV and IRR

Suppose a company considers two projects, each requiring an initial investment of $10,000.

- Project A returns $4,000 per year for 3 years.

- At a 10% discount rate → NPV = $1,486; IRR ≈ 18%.

- Project B returns $3,000 per year for 5 years.

- At a 10% discount rate → NPV = $1,137; IRR ≈ 15%.

Decision: Both projects create value (positive NPV), but Project A offers a higher return percentage, while Project B provides steady cash flows over a longer period.

Key Takeaway

- With NPV IRR explained, it’s clear they complement each other:

- NPV helps decide whether to accept or reject a project.

- IRR helps compare multiple projects by showing their relative profitability.

NPV vs IRR: Key Differences

While both are essential in investment analysis, there are important distinctions between the two. Understanding the difference between NPV and IRR ensures better financial decision-making.

Core Distinctions

- NPV (Net Present Value) measures the absolute value (in dollars) an investment adds, after discounting future cash flows.

- IRR (Internal Rate of Return) is the percentage rate of return at which NPV becomes zero, showing the efficiency of the investment.

When to Use Each

NPV is Better:

- When comparing projects of different sizes (a project with higher NPV creates more wealth, even if IRR is lower).

- When discount rates vary or are uncertain.

- For absolute value-focused decisions.

IRR is Useful:

- For comparing the attractiveness of multiple projects expressed as percentages.

- When investors want to see the break-even rate of return.

- For communicating investment potential in simple terms.

Comparison Table: NPV vs IRR

| Feature | NPV (Net Present Value) | IRR (Internal Rate of Return) |

|---|---|---|

| Type of Measure | Absolute value (dollars created) | Relative measure (percentage return) |

| Decision Rule | Accept if NPV > 0 | Accept if IRR > cost of capital |

| Best Use Case | Projects with different scales | Comparing investment efficiency |

| Strength | Shows actual wealth created | Easy to compare across opportunities |

| Limitation | Requires a discount rate assumption | May give misleading results with uneven cash flows |

Advantages and Limitations of NPV

Like any financial metric, Net Present Value has strengths and weaknesses. Understanding NPV advantages and NPV limitations helps decision-makers apply it effectively in real-world scenarios.

Advantages of NPV

- Considers the Time Value of Money: Unlike simple payback methods, NPV discounts future cash flows, ensuring they are compared in today’s terms.

- Straightforward Interpretation: A positive NPV means the project adds value, while a negative NPV means it destroys value—making it easy to interpret results.

- Flexibility Across Investments: NPV can be applied to projects, acquisitions, bonds, and other financial decisions.

- Helps Maximize Shareholder Value: By focusing on absolute wealth creation, NPV aligns closely with business and investor objectives.

Limitations of NPV

- Depends on Discount Rate Accuracy: Small changes in the chosen discount rate can significantly alter results, creating uncertainty.

- Ignores Non-Financial Factors: Strategic goals, environmental impact, or social benefits are not captured in NPV calculations.

- Less Useful for Comparing Project Sizes: Larger projects tend to show higher NPV, even if smaller projects have higher returns relative to their size.

- Complex with Irregular Cash Flows: While Excel and XNPV help, NPV can be less intuitive when cash flows are uneven.

Explore Courses From Our Top Categories:

➡️Business Training Courses – ➡️ Data Training Courses – ➡️ Technical Training Courses – ➡️ HSSE Training Courses

FAQs on NPV and IRR

What is the difference between NPV and IRR?

The key distinction in the NPV vs IRR debate is that NPV measures the absolute dollar value created by an investment, while IRR gives the percentage rate of return at which the NPV becomes zero. NPV shows wealth added, whereas IRR shows efficiency.

Why is NPV important in finance?

Understanding what is NPV in finance is crucial because it helps investors and businesses determine whether a project will add value after considering the time value of money. A positive NPV means the project is likely to be profitable, while a negative NPV signals potential losses.

What discount rate should I use for NPV?

The discount rate usually reflects the company’s cost of capital or the required rate of return. In practice, it may vary depending on the risk of the project or the opportunity cost of choosing one investment over another. Selecting the right rate is critical since NPV results are highly sensitive to it.

Can NPV be negative?

Yes. A negative NPV means the present value of cash inflows is less than the initial investment and outflows, indicating the project will destroy value rather than create it. In such cases, the investment should generally be rejected unless there are strong strategic reasons to proceed.

Conclusion

The net present value (NPV) remains one of the most critical tools in investment appraisal and corporate finance. By incorporating the time value of money, it provides a clear measure of whether a project or investment will create or destroy value. Unlike simpler methods, NPV captures the true economic worth of future cash flows, making it indispensable for investors, managers, and decision-makers.

In practice, using NPV in finance alongside complementary metrics such as IRR gives a more complete perspective. While NPV shows the absolute wealth created, IRR highlights the efficiency of returns. Together, they help businesses evaluate opportunities more accurately and make informed strategic choices.

To strengthen decision-making skills, readers are encouraged to practice calculating NPV using Excel or financial calculators, experimenting with different discount rates and cash flow scenarios. By doing so, both individuals and organizations can improve their ability to evaluate investments, reduce risk, and maximize value creation.

Also Read: