How to Calculate DCF? Valuation, Analysis, and the Role of WACC

Why DCF Matters in Valuation

Understanding how to calculate DCF is a cornerstone of modern financial analysis. The Discounted Cash Flow (DCF) method estimates the present value of an investment, company, or project by projecting its future cash flows and discounting them back to today’s terms. This approach helps determine whether an opportunity is undervalued, fairly priced, or overpriced.

The importance of DCF valuation is clear because it focuses on intrinsic value rather than market noise. Unlike multiples-based comparisons, it evaluates real financial performance and growth potential. This makes DCF especially valuable in situations where market sentiment is volatile or when assessing unique projects.

Why DCF Matters in Finance

- For investors: Provides a way to judge whether a stock or asset is priced correctly compared to its intrinsic value.

- For analysts: Serves as a structured framework to test assumptions, evaluate scenarios, and present valuations credibly.

- For businesses: Supports capital budgeting, merger & acquisition decisions, and long-term strategic planning.

- For risk management: Accounts for the time value of money and adjusts for risk via the discount rate.

Because DCF incorporates both future potential and risk, it is widely recognized as one of the most rigorous valuation techniques in finance. By learning how to apply it correctly, professionals can make data-driven, long-term decisions that create sustainable value.

The DCF Formula Explained

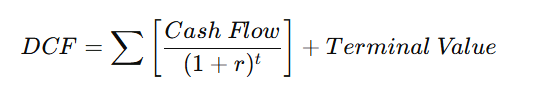

At its core, the discounted cash flow formula is designed to calculate the present value of future cash flows. It combines projected free cash flows during the forecast period with a terminal value that captures performance beyond that horizon.

Key Components of the Formula

- Cash Flows (CF): The projected free cash flows generated by the business or project.

- Discount Rate (r): Usually the Weighted Average Cost of Capital (WACC), representing risk and opportunity cost.

- Time Period (t): The specific year or period when each cash flow occurs.

- Terminal Value (TV): The estimated value of the company after the forecast period, often calculated using the perpetuity growth method or exit multiples.

Why This Matters

The DCF calculation basics show how the model adjusts for the time value of money. A dollar today is worth more than a dollar tomorrow, so future inflows are discounted to reflect present-day value. Adding the terminal value ensures long-term growth potential is not ignored.

Quick Illustrative Example

- Initial investment: $1,000

- Forecasted cash flows: $400 (Year 1), $500 (Year 2), $600 (Year 3)

- Discount rate: 10%

- Terminal value at end of Year 3: $2,000

Calculation:

- Year 1: 400 ÷ (1 + 0.10)^1 = $363.64

- Year 2: 500 ÷ (1 + 0.10)^2 = $413.22

- Year 3: 600 ÷ (1 + 0.10)^3 = $450.77

- Terminal Value: 2000 ÷ (1 + 0.10)^3 = $1501.20

Total DCF = $2,728.83

This simple illustration shows how the discounted cash flow formula turns projected earnings into a realistic measure of present value.

How to Calculate DCF Step by Step

Knowing how to calculate DCF turns valuation from guesswork into a structured, testable process. Here’s a clear, DCF step-by-step workflow you can follow on any business or project.

Step 1: Forecast Free Cash Flows (Years 1–5/10)

- Project operating performance (revenue, margins, taxes, CapEx, working capital).

- Compute Free Cash Flow (FCF) each year:

- Unlevered FCF ≈ EBIT × (1–Tax) + Depreciation & Amortization – CapEx – ΔNWC.

- Use drivers tied to the business model (price/volume, unit economics, utilization, churn, etc.).

Step 2: Determine the Discount Rate (WACC)

- Use WACC for unlevered FCFs (blended cost of equity & after-tax debt).

- Reflect the company’s risk (beta, leverage, country risk) and current market rates.

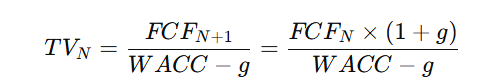

Step 3: Estimate Terminal Value (TV)

Choose one method at the end of the explicit forecast (Year N):

- Perpetuity Growth (Gordon):

Exit Multiple: Apply an industry multiple (e.g., EV/EBITDA) to Year N metric.

Step 4: Discount to Present Value

- Discount each annual FCF and the terminal value back to today using WACC:

Discount to Present Value

Step 5: Sum to Enterprise Value (and Bridge to Equity)

- Enterprise Value (EV) = ∑PV(FCFt)+PV(TV)\sum PV(FCF_t) + PV(TV)∑PV(FCFt)+PV(TV)

- Equity Value = EV – Net Debt (Debt – Cash) ± other adjustments (non-operating assets, minorities).

Mini Numerical Example (concise)

Assumptions: Unlevered FCFs (Years 1–5) = 100, 120, 140, 160, 180; WACC = 10%; g = 3% (perpetuity).

- Terminal Value at Year 5: TV5=180×1.030.10−0.03=2,648.57TV_5=\frac{180\times1.03}{0.10-0.03}=2{,}648.57TV5=0.10−0.03180×1.03=2,648.57

- PV of FCFs (Y1–Y5): 90.91 + 99.17 + 105.18 + 109.28 + 111.77 = 516.31

- PV of TV: 2,648.57/(1.10)5=2{,}648.57/(1.10)^5 =2,648.57/(1.10)5= 1,644.55

- Enterprise Value (EV): 2,160.87 (= 516.31 + 1,644.55)

- (Optional) If Net Debt = 300 → Equity Value ≈ 1,860.87.

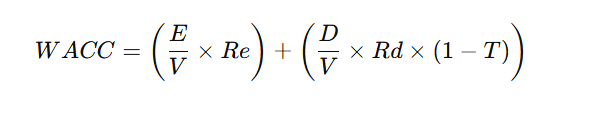

Using WACC for DCF

One of the most critical steps in valuation is selecting the discount rate in DCF. The most common choice is the Weighted Average Cost of Capital (WACC), which represents the blended cost of a company’s equity and debt financing. WACC reflects the minimum return investors expect, making it the logical benchmark for discounting future cash flows.

What is WACC?

The WACC for DCF is calculated as:

Where:

- E = Market value of equity

- D = Market value of debt

- V = Total capital (E + D)

- Re = Cost of equity (often from CAPM)

- Rd = Cost of debt (interest rate on borrowings)

- T = Corporate tax rate

Why Use WACC in DCF?

- Ensures consistency: Matches unlevered free cash flows with the blended cost of financing.

- Captures both shareholder and lender expectations.

- Adjusts for risk: Higher WACC reflects higher risk, lowering present values.

- Prevents overvaluation: A proper discount rate avoids inflating intrinsic value.

Example of WACC Calculation

Suppose a company finances itself with:

- Equity (E): $600m at 60% of capital structure

- Debt (D): $400m at 40% of capital structure

- Cost of equity (Re): 12%

- Cost of debt (Rd): 6%

- Tax rate (T): 30%

WACC=(0.60×0.12)+(0.40×0.06×(1−0.30))WACC = (0.60 \times 0.12) + (0.40 \times 0.06 \times (1-0.30))WACC=(0.60×0.12)+(0.40×0.06×(1−0.30)) WACC=0.072+0.0168=8.88%WACC = 0.072 + 0.0168 = 8.88\%WACC=0.072+0.0168=8.88%

Application in DCF Valuation

- Lower WACC: Increases present value of cash flows → higher valuation.

- Higher WACC: Decreases present value → lower valuation.

- Practical tip: Always test valuations at different WACCs (sensitivity analysis) to see how assumptions affect results.

Using the discount rate in DCF correctly ensures that the valuation reflects both the company’s risk profile and its financing structure, giving investors a realistic picture of intrinsic value.

Explore Courses From Our Top Categories:

➡️Business Training Courses – ➡️ Data Training Courses – ➡️ Technical Training Courses – ➡️ HSSE Training Courses

Discounted Cash Flow Analysis: Interpreting Results

Once the valuation is complete, the real skill lies in discounted cash flow analysis—interpreting what the results actually mean for investment decisions. Because the model is assumption-driven, analysts must go beyond the headline number and evaluate both the outputs and the sensitivity of the inputs.

Positive vs. Negative DCF Results

- Positive DCF Value (above market price): Suggests the company or project is undervalued and may represent a good investment opportunity.

- Negative DCF Value (below market price): Indicates the asset may be overvalued or incapable of generating returns that exceed the cost of capital.

- Near-zero DCF Value: Signals that the project or asset just about meets the required rate of return, with limited margin of safety.

Sensitivity Analysis: Testing Assumptions

A key part of DCF interpretation is sensitivity testing, as small changes in assumptions can drastically impact valuation outcomes. Analysts often test variables such as:

- Discount rate (WACC) ± 1–2%

- Long-term growth rate (perpetuity assumption)

- Operating margins and capital expenditure needs

By running multiple scenarios, investors gain a clearer view of best-case, base-case, and worst-case outcomes.

Strengths of DCF Analysis

- Focuses on intrinsic value rather than market sentiment.

- Incorporates time value of money, making it more accurate than simple payback methods.

- Flexible—can test multiple scenarios and assumptions.

Weaknesses of DCF Analysis

- Highly sensitive to assumptions; small input changes can alter results dramatically.

- Complex and time-intensive compared to multiples-based methods.

- May be less reliable for startups or highly cyclical businesses with unpredictable cash flows.

In summary, effective discounted cash flow analysis is not just about calculating a single number—it’s about interpreting results in context, testing assumptions, and balancing the method’s strengths with its limitations.

Common Mistakes in DCF Calculations

Even though the discounted cash flow approach is one of the most rigorous valuation techniques, it is also prone to errors that can distort results. Recognizing these DCF mistakes helps ensure more reliable and realistic outcomes.

-

Over-Optimistic Growth Assumptions

- One of the most frequent errors in DCF valuation is projecting unrealistically high revenue or cash flow growth.

- Inflated assumptions can make an investment appear undervalued when in reality it may not generate such performance.

- Best practice: Base projections on historical performance, industry trends, and conservative growth estimates.

-

Wrong WACC Selection

- Using an inappropriate discount rate can lead to misleading valuations.

- A too-low WACC exaggerates value, while a too-high WACC unfairly discounts future returns.

- Best practice: Carefully calculate WACC using market-based inputs for equity and debt costs.

-

Ignoring Working Capital Changes

- Many analysts overlook the impact of changes in receivables, payables, and inventory.

- Since working capital directly affects free cash flow, ignoring it can distort valuation outcomes.

- Best practice: Incorporate realistic working capital adjustments in every forecast period.

-

Relying Too Heavily on Terminal Value

- In many models, terminal value contributes 60–80% of total DCF value.

- Over-reliance can mask errors in earlier forecasts and make results overly sensitive to long-term assumptions.

- Best practice: Ensure explicit period forecasts are robust and stress-test terminal growth and multiples.

By avoiding these common DCF mistakes, analysts can improve the credibility of their models and provide stakeholders with valuations grounded in financial reality.

FAQs on DCF Valuation

What is the purpose of DCF valuation?

The main purpose of DCF valuation is to estimate the intrinsic value of a company, project, or investment by discounting future cash flows to their present value. This helps investors and businesses decide if an opportunity is undervalued, fairly priced, or overvalued.

Is DCF better than multiples valuation?

Not necessarily—it depends on context. DCF valuation focuses on intrinsic value, making it useful for long-term decisions and unique businesses. Multiples-based valuation (e.g., EV/EBITDA, P/E) is quicker, market-driven, and easier to apply when comparable data exists. In practice, analysts often use both methods to cross-check results.

When should I not use DCF?

The discounted cash flow model is less effective when:

- Cash flows are highly unpredictable (e.g., startups or distressed businesses).

- Reliable long-term assumptions are unavailable.

- Industry comparables provide a faster, more realistic benchmark.

In these cases, other methods such as comparables, precedent transactions, or asset-based valuations may be more appropriate.

Conclusion

The discounted cash flow (DCF) valuation remains a cornerstone of modern finance because it focuses on intrinsic value and accounts for the time value of money. By projecting free cash flows and discounting them with the appropriate WACC for DCF, analysts and investors can uncover whether an asset is truly undervalued or overpriced.

At the same time, it is important to remember that the method is assumption-sensitive. Small changes in growth forecasts, discount rates, or terminal value assumptions can shift the outcome significantly. This is why seasoned professionals never rely on a single set of inputs but instead run sensitivity analyses and compare results with other valuation methods.

If you want to strengthen your skills, start by practicing how to calculate DCF in Excel using real-world financial data. Build forecasts, calculate WACC, and run scenarios to see how valuations change under different assumptions. Over time, this hands-on practice will give you the confidence to apply DCF effectively in corporate finance, investment banking, or personal investing decisions.

The key takeaway: master the mechanics, challenge your assumptions, and let DCF valuation guide you toward better-informed, data-driven decisions.

Also Read: